Interested in learning more about how I can help you navigate this real estate market in your area or in other markets across the country?

Let’s set up a time to connect. Call me any time at 510-406-4836

Best,

Joujou

Clever ways to incorporate Pantone’s rich & vibrant color of 2023, Viva Magenta:

Florals ~ Brighten your floral arrangements by using vibrant magenta-hued blooms such as peonies, ranunculus, and dahlias alongside complementary greenery.

Paint Color – Captivate your guests with a lacquered accent wall in a small space, such as a powder room or hallway. Pair it with complementary colors such as soft grays, warm beiges, and muted blues for a harmonious and balanced look.

Pillows & Throws – For accent pillows and throws, choose fabrics rich in shades of Viva Magenta to stand out from the neutral-colored furnishings you already have in your home for a bold and modern look.

Artwork – Choose art pieces that feature bold magenta hues or incorporate Viva Magenta into the matting or framing of existing artwork to add a pop of color and create a dynamic look.

-

A home renovation now takes 79 days on average, up 259% from 22 days in 2019, according to Jobber (when did a home take 3 weeks to renovate??), an operations-management company whose software is used by home-service professionals. Remodeling is more expensive: Hourly wages for general construction workers are up 42% over the same period, from $35 to $49, according to insurance analytics firm Verisk. Material costs are up too. Spending on home-improvement and repair projects in the U.S. increased by an estimated 15% in 2022 to a record $567 billion, following an 11% increase in 2021. Total homeowner spending on do-it-yourself improvement projects grew 44% between 2019 and 2021, to a record of $66 billion, according to the Harvard report. (WSJ)

-

In a 2020 survey by Gen Z Planet, 87% of respondents said they wanted to own a home, while just 63% of millennial respondents said the same, suggesting that 68% of Gen Zers viewed homeownership as a way to build wealth, compared with 60% of millennials. Another 2021 survey found that 86% of Gen Z respondents want to buy a home, and 45% want to buy within the next 5 years. Millennials accounted for about 43% of all home purchases in the US in 2021, according to the NAR, Gen Z just 2%, though the NAR only counted Gen Zers who were born in 1999 or later. Another study looking at Gen Zers born in 1997 or later, found they accounted for an average of 10% of homebuyers in the 50 largest US metros in 2021, up from nearly 6% in 2020. (INSIDER)

-

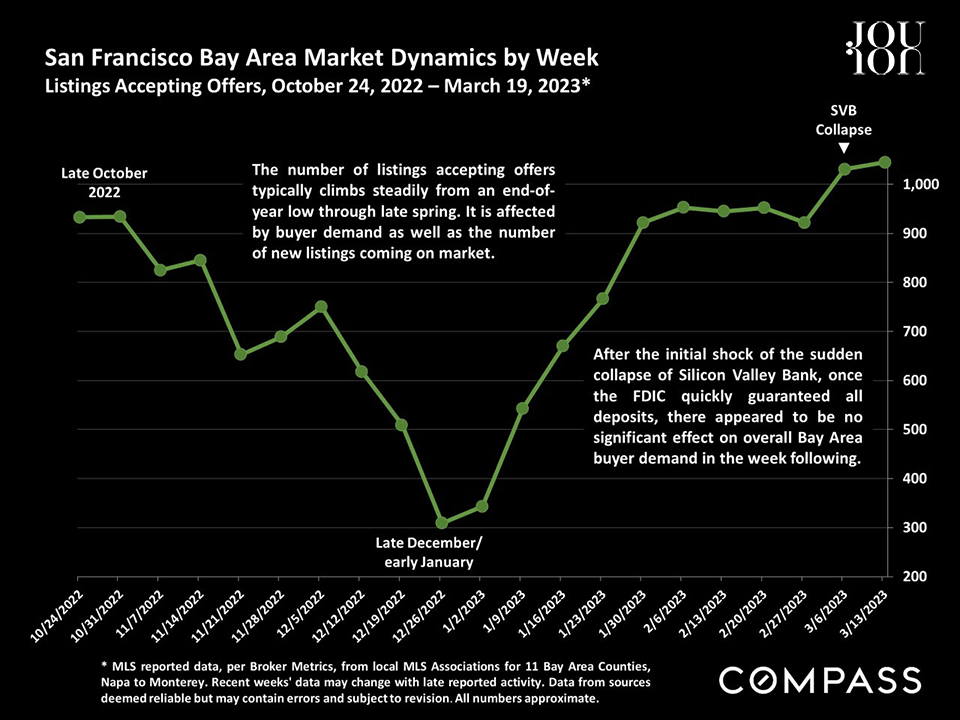

Concerns of a credit crunch, which occurs when banks significantly tighten their lending standards, have grown amid the banking crisis.If tighter lending conditions are sustained, FED chief Powell acknowledged that could easily have a significant macroeconomic impact which would be factored into the Fed’s policy decisions. After the past week’s banking challenges, anyone thinking credit will not tighten may be dreaming… (CNBC)

-

Sales of previously owned homes rose 14.5% in February compared with January, according to the NAR, the first monthly gain in 12 months and the largest increase since July 2020, just after the start of the pandemic. Higher mortgage rates cooled home prices since last summer, and for the first time in a record 131 consecutive months – nearly 11 years – prices were lower on a year-over-year comparison. Home price inflation is still seen – but lower – in the Midwest and Southeast. Home price DEFLATION is being seen in the Northeast and West.

-

The 30-year fixed-rate mortgage averaged 6.42% as of Mar. 16, down from 6.6% recorded last week. A year ago, the 30-year averaged 4.42%. Meanwhile, the 15-year fixed-rate mortgage averaged 5.68%, down from last week when it averaged 5.90% up from a year ago at 3.63%. (CNBC)

-

People poured more than $115 billion into Treasury bills and commercial paper during the week that ended March 22, the largest weekly net inflow since the spring of 2020. However the media scandal-for-profit headlines are somewhat misleading: Large institutions saw deposits increase by $67 billion, while smaller banks saw outflows of $120 billion. The withdrawals brought total deposits down to just over $17.5 trillion and represented about 0.6% of the total. Deposits have been on a steady decline over the past year or so, falling $582.4 billion since February 2022, A net outflow of cash of $53 billion out of $17-plus TRILLION…..(WSJ) & (CNBC)

-

The Fed has been so focused on curbing inflation that it has essentially ignored the risks of its policy of raising rates more quickly than at any point in history. It has acted as if inflation is such a threat to financial stability that it lost sight of the fact that fighting inflation can, if pursued in too draconian a fashion, can itself be a threat to financial stability. (TIME)

-

“Cryptocurrency has historically been marketed as a “hedge against inflation,” but it’s really a hedge against catastrophe. Which is to say, a bet on catastrophe. Crypto is becoming the ultimate libertarian scheme — the world’s first asset class that encourages you to stop investing in America, and quit. The venture catastrophists now have a vested interest in the nation’s decline. They’ve invested too much in Doomsday not to root for it, maybe even catalyze it. Balaji has a million dollars on the line; Andreessen Horowitz has $8 billion. There’s a lot wrong with America, and we have reason to be upset about it. The question is: What do we do about it? For too many, the answer is quit: Instead of fixing the Fed, start a different currency. Instead of healing our divides, split the nation in two. Instead of making this planet more habitable, colonize other planets or put a headset on that takes you to a meta (better) universe. But here’s the thing: We’re stuck here, and with each other. History’s greatest leaders aren’t quitters, but reformers. In the U.S., our threats are also real, but powerful people are dressing them up to suit their own nihilism and self-interest. These anti-citizens do not see dead people (a much better film), but tear at the fabric of what is, and continues to be, the great experiment that is the U.S. They should be called out for what they are: cowards.” – Scott Galloway.

-

New York was home to the world’s first branded residence: the five-star Sherry Netherland hotel kick-started the concept by offering butlers and cocktails to its long-term residents in the 1920’s. (FT)

-

$1.5 trillion of commercial real estate loans are coming due in the next 3 years, loans made at rates close to 1%. Refinancing at higher rates with lower values will be a major challenge. 80% of commercial loans are regional banks. Thankfully, most large commercial properties are owned by larger, rich entities. Many retirement and pension funds are invested in commercial real estate.

-

Municipalities get about 70% of their revenues from commercial real estate…..so anyone thinking commercial real estate problems are not MY problem, think again!

-

If the biggest threat to banks is (often unfounded) depositor panic withdrawals, surely the easiest solution is to offer an insurance premium to depositors depositing amounts about the FDIC-insured threshold of $250,000? Its being discussed already….. we insure homes valued at $500k and $20 million, why not deposits? (CNBC)

-

The New York metro area is home to 5,100 life sciences companies – about 30% more than Boston – and nearly 150,000 jobs in life sciences, 14,000 more than San Francisco, the 2nd-largest market for jobs in the sector. (FT)

-

TESLA plans to slash the cost of building next-generation EV cars by 50% in coming years…..deflation perhaps? Maybe the original concept of EV’s – to reduce energy consumption – may happen after all? (PS: those mega-hyper-fast-and-powerful EV’s use LOTS of energy!)

-

The 44-story, 659-unit fully furnished West Eleventh Residences in Miami’s Arts District will be the first centrally managed luxury condo tower allowing owners to host 365 days on Airbnb. The turn-key studios and one-bedroom residences are priced from the mid $400,000’s.

-

Credit Suisse – the 167 year old Swiss bank – was acquired by UBS in a deal valued around $3.23 billion, the first huge crisis bank merger since the 2008 financial crisis. At the end of 2022, the amount of insured deposits in all FDIC insured institutions nationwide was just over $10 trillion, or about 50% of the total deposits nationwide…….At both Silicon Valley Bank and Signature Bank, more than 90% of deposits were uninsured. New York Community Bank is buying out a major portion of Signature Bank for $2.7 billion. (FT) & (NYT)

-

In 2021, Elon Musk paid about $11 billion in taxes, slightly more than the close-to-zero taxes some politicians, headlines and tweets suggest the very rich pay. The disparity in taxes paid WITHIN the classes varies dramatically where some are entitled to massive tax breaks and others are not, depending on their influence on those that make our laws….. and yes, some avoid taxes legally, semi-legally and illegally. That happens at all levels: In the US annually about $188 billion is lost due to tax fraud. But it’s not just billionaire’s not paying their ‘fair share’…..

~Leonard Steinberg

COMPASS Catch

7 Bed | 6 Bath | $22,500,000 | Justin Alexander

A remarkable world-class residence on one of the best triple lots in all of Santa Monica. Surrounded on all sides by 40-foot hedges and mature trees, this magical and serene setting is one of the most significant coastal offerings to date. Charles and Henry Greene were commissioned by businessman Charles Witbeck in 1917 to create a large two-story shingle-style house that would exude East Coast charm in a California setting.

♦ 5 Bed | 6 Bath | 2 Half Bath | $35,000,000 | Lexi Cerretti

5 Bed | 6 Bath | 2 Half Bath | $35,000,000 | Lexi Cerretti

Wovoka is an idyllic estate set along crystal clear waters of Lake Tahoe’s east shore and a protected sandy cove. This architecturally acclaimed residence blends extensive custom woodwork, textured concrete surfaces, and natural stone with in-floor heating radiating warmth, reflecting the rugged beauty of its surroundings.

♦ 3000 Eminencia Del Sur, San Clemente, CA

6 Bed | 5 Bath | 3 Half Bath | $6,750,000 | Tracy Weintraub

3000 Eminencia Del Sur, San Clemente, CA

6 Bed | 5 Bath | 3 Half Bath | $6,750,000 | Tracy Weintraub

Completely reimagined and remodeled, this stunning custom Spanish single-story compound in the exclusive Forster Estates enclave of Forster Ranch in San Clemente is ready to dramatically enrich your lifestyle. Offering panoramic hill views and glimpses of the ocean, this sprawling estate offers the advantages of a coveted corner homesite that hosts an inviting front yard with a sunny patio, and a gated motor court with a five-car garage.

♦ 4 Bed | 4.5 Bath | $9,980,000 | Danielle Wilson and Colleen Kelly

4 Bed | 4.5 Bath | $9,980,000 | Danielle Wilson and Colleen Kelly

Nestled on the hillside overlooking forever views of city lights and the deep blue sea, this enchanting architectural marvel is a study of elegance and charm. Completely redesigned and reinvented in 2022 this modern farmhouse is a perfect marriage of Italian style, Spanish flair, and present-day finishes. Capturing the true essence of the California Riviera lifestyle and perfect for lavish entertaining or as a relaxing sanctuary.

Facebook | Instagram | Twitter | YouTube | Pinterest

|